LifeVantage Files Definitive Proxy Statement

Issues Letter to Stockholders Highlighting the Company’s Transformation and Progress with LV360 Plan

Board Comments on the Radoff-Sudbury Group’s Distracting and Costly Campaign to Remove and Replace Highly Qualified, Experienced Directors, Giving them Outsized and Unwarranted Representation on the Board

Board Urges Stockholders to Vote on the WHITE Universal Proxy Card “FOR” LifeVantage’s Seven Highly Qualified Director Candidates

- CEO

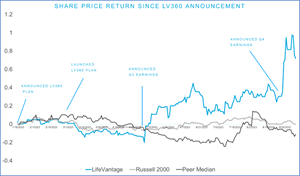

Steve Fife’s continued execution of the LV360 plan, which is delivering value to ALL LifeVantage stockholders—since the announcement of LV360,LifeVantage shares have outperformed the Russell 2000 Index and its Peer Median by 71.9 and 82.9 percent, respectively; - The Company’s balanced capital allocation strategy that is returning value to stockholders through share repurchases, regular dividends and a special dividend;

- Our commitment to Board refreshment, including appointing five of the Board’s current directors since 2017;

- Repeated engagements with the

Radoff-Sudbury Group to avoid a distracting proxy fight; and The Radoff-Sudbury Group is seeking outsized board representation (40% of the Board relative to a 12% ownership stake). They are also threatening to replace three of our highly qualified directors with candidates with apparently inferior skillsets and potential conflicts of interest, whose only articulated plans to-date are already being implemented by the Company.

The full text of the letter follows:

Dear Fellow Stockholders,

At this year’s annual meeting of stockholders (the “Annual Meeting”) of

Unfortunately,

The Annual Meeting will be held on

Our Proactive Steps Are Driving Strong Results and Delivering Stockholder Returns

Three years ago, the Company was facing an uncertain future. The Company’s business model needed to evolve as the direct selling market was rapidly changing. The management team at the time was underperforming and lacked the skills and strategic vision necessary for the future. The Board itself also recognized that it lacked the skills and perspectives amongst its directors to help guide management in navigating this fast-evolving environment. In response, your Board took decisive action to proactively address these challenges by:

- Accelerating and enhancing its refreshment process, adding new skills and diverse perspectives to the boardroom;

- Overhauling the management team, starting with appointing a new CEO;

- Overseeing the launch of a new strategic plan; and

- Guiding management to develop and implement a capital allocation strategy that balanced the necessary investments in the business, while also prudently returning capital to stockholders.

Additionally, the refreshed Board oversaw the development and execution of LV360, the Company’s strategic transformation plan, which was announced in early 2023. Those changes are working and they are delivering stockholder returns. Since the announcement of LV360 (described below), on

1 LifeVantage’s channel peer group consists of the following public companies: Herbalife, Nu Skin Enterprises, Nature’s Sunshine Products, Mannatech and

Source: Factset

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ffa7ebe7-8628-4c50-b3bc-d3f707fa5a5e

LV360 Strategic Transformation

The execution of LV360 is focused on six main categories:

- Product – Attract and retain new consumers with modern branding and exciting products that fit consumer demand, are aligned with macro tailwinds, meet true health needs and are positioned for social amplification.

- Social – Inspire a growing, engaged and connected community that encourages wellness enthusiasts to continuously feel better, fuel their purpose and celebrate what it means to “live activated”.

- Compensation – A modernized “Evolve Compensation Plan” helps new consultants earn faster, enables work flexibility and gives them the ability to earn from both sales to customers and also through building a team of consultants, who in turn, sell products.

- Consumer Experience –

Launch Rewards Circle , a customer loyalty program that builds trust, creates positive experiences and provides compelling motivation for placing repeat orders. - Digital – Create a connected, digital-first culture to enhance customer relationships and support the consultant experience.

- One

LifeVantage Community – Grow the community of those positively impacted byLifeVantage by entering new markets, growing existing markets and leaving a legacy of a better world for all.

Not only is the Board’s oversight of this enhanced strategy delivering returns to all

2 Please see LifeVantage’s “Statement regarding use of non-GAAP financial measures” below for more information.

Prudent and Balanced Capital Allocation

During the early execution phases of the LV360 plan, the Company took a conservative approach to cash management. The Company maintained a debt-free and cash positive position while we launched LV360 to ensure that we responsibly managed the risks associated with the strategic transformation. As the LV360 plan began producing robust results,

- Since the announcement of LV360 through

June 30, 2023 ,LifeVantage has repurchased$0.8 million of its shares representing 11.4% of operating cash flow (betweenJanuary 1, 2023 andJune 30, 2023 ), reducing shares outstanding by 1.4%, net of additions; LifeVantage initiated a quarterly cash dividend beginning inMay 2022 , which increased by 16.7% to$0.035 per share inMay 2023 ; and- On

August 28, 2023 ,LifeVantage announced a special, one-time cash dividend of$0.40 per share, payable onSeptember 22, 2023 to stockholders of record as of the close of business onSeptember 8, 2023 , which represents, in the aggregate, approximately$5 million returned to stockholders.

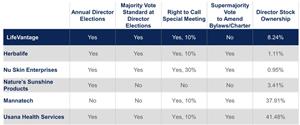

“Best in Class” Corporate Governance

LifeVantage’s growth is supported by strong, stockholder-aligned corporate governance, which is more investor friendly than that of our key peers:

Source: Factset

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fa10fc98-3023-4ed5-b10d-2a7bbee2badb

From mid-2021 through

In Radoff’s initial Schedule 13D filing on

In an attempt to avoid an unnecessary and costly proxy fight,

At no point during our extensive conversations have Radoff or Judd offered any alternative plans to create value. Quite the contrary, Radoff and Judd have even acknowledged LifeVantage’s positive results since announcing the LV360 plan. Yet, they are seeking to replace three of our highly-qualified Board members (40% of our Board) including

Moreover, two of the

In addition to these potential conflicts of interest, the Radoff-Sudbury Group’s candidates’ qualifications pale in comparison to those of the directors they are seeking to oust. The mixed track record of the Radoff-Sudbury Group’s nominees on other company boards and management teams does not give confidence that the

3 Please see LifeVantage’s “Statement regarding use of non-GAAP financial measures” below for more information.

Board and Management Refreshment

Our Board has a healthy mix of longer, medium and shorter tenures, which enables the sharing of institutional knowledge, allows for fresh perspectives and allows the Board to have independent oversight of management, yet has a productive and collaborative relationship with it.

- Since 2017,

LifeVantage has replaced five directors and appointed five current directors to the Board. These directors have brought highly relevant perspectives and diverse experience around growth strategy, fiscal discipline and direct selling experience:Ray Greer (February 2017 )Darwin Lewis (February 2017 )Erin Brockovich (May 2019 )Steven Fife (February 2021 )Cynthia Latham (February 2022 )

- Since

Vinayak Hegde left the Board, the Board has been seeking to add a new director with a strong background in digital marketing and ecommerce. Our aim to find a candidate with those skillsets has been consistently communicated to theRadoff-Sudbury Group . - LifeVantage’s average Board tenure (6.5 years) is lower than the average of its peer group (7 years), reflecting the Board’s commitment to regular Board refreshment, and as noted above, properly balances a mix of more-tenured and newer directors to provide a constructive dialogue in the boardroom.

Board refreshment is ongoing. During Garry Mauro’s tenure as Chair, he has been purposeful in overseeing a robust and regular director evaluation program and has engaged with third-party recruiters to identify and attract independent directors with the skills needed to meet the evolving needs of the Company.

As a result of this strategic refreshment, the Board is composed of experienced, engaged and diverse directors, with the relevant skills to oversee the continued execution of the LV360 plan. We believe that the skills and knowledge base of our Board is far stronger than that of the Radoff-Sudbury Group’s nominees.

Specifically,

Beyond our Board strength, the Board has also brought renewed energy and strategic focus to the executive team. In

Vote on the WHITE Universal Proxy Card

Now is not the time to change direction as the strategy gains momentum and clear results. Stockholders must make their voices heard and ensure that all

We encourage stockholders to disregard any blue universal proxy card sent to you by the

Stockholders who have any questions or need assistance voting their shares may contact the Company’s proxy solicitor

Thank you for your support and investment in

Sincerely,

The LifeVantage Board of Directors

About

Cautionary Note Regarding Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "will," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to," "goal," “may be,” and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. The declaration and/or payment of a dividend during any quarter provides no assurance as to future dividends, and the timing and amount of future dividends, if any, could vary significantly in comparison both to past dividends and to current expectations. Examples of forward-looking statements include, but are not limited to, statements we make regarding executing against and the benefits of our key initiatives, future growth, including geographic and product expansion, the impact of COVID-19 on our business, expected financial performance, and expected dividend payments in future quarters. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, further deterioration to the global economic and operating environments as a result of future COVID-19 developments, as well as those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company's Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting. The Company filed its definitive proxy statement and a WHITE universal proxy card with the

Statement About Non-GAAP Financial Measures

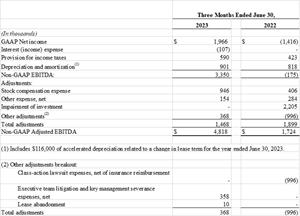

This letter includes information about certain financial measures that are not prepared in accordance with GAAP, including Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin. We define Non-GAAP Adjusted EBITDA as earnings before interest expense, income taxes, depreciation and amortization, stock compensation expense, other income, net, and certain other adjustments and Non-GAAP Adjusted EBITDA margin as Non-GAAP Adjusted EBITDA divided by total revenue. Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin may not be comparable to similarly titled measures reported by other companies.

We are presenting Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin because management believes that they provide additional ways to view our operations when considered with both our GAAP results and the reconciliation to net income, which we believe provides a more complete understanding of our business than could be obtained absent this disclosure. Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin are presented solely as supplemental disclosure because: (i) we believe these measures are a useful tool for investors to assess the operating performance of the business without the effect of these items; (ii) we believe that investors will find this data useful in assessing stockholder value; and (iii) we use Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin as benchmarks to evaluate our operating performance or compare our performance to that of our competitors. The use of Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted EBITDA margin has limitations and you should not consider these measures in isolation from or as an alternative to the relevant GAAP measure of net income prepared in accordance with GAAP, or as a measure of profitability or liquidity.

The table set forth below presents reconciliation of Non-GAAP Adjusted EBITDA, which is a non-GAAP financial measure to Net Income, our most directly comparable financial measure presented in accordance with GAAP.

Investor Relations Contact:

(646) 277-1260

reed.anderson@icrinc.com

Media Relations Contact:

Dan.McDermott@icrinc.com

LIFEVANTAGE CORPORATION AND SUBSIDIARIES

Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA:

(Unaudited)

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5984f98f-e575-494b-97e6-ce36af216f83

Share Price Return Since LV360 Announcement

Share Price Return Since LV360 Announcement

“Best in Class” Corporate Governance

“Best in Class” Corporate Governance

Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA (Unaudited)

Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA (Unaudited)

Source: LifeVantage Corporation